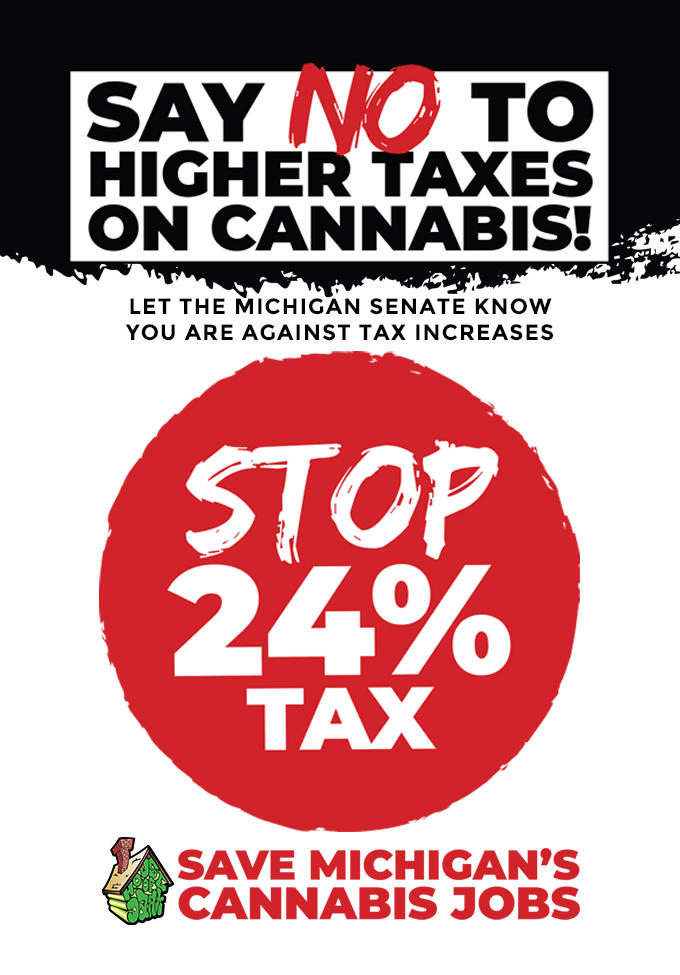

Michigan lawmakers are pushing a 24% wholesale tax increase on cannabis. On paper, it’s supposed to help fund road repairs. But for consumers and communities, it means something very different: higher prices, fewer options, and a risk of pushing people back to the black market.

Why You Should Care

- Your prices will go up. A 24% wholesale tax doesn’t just hit growers and retailers — it trickles down to you. That $40 eighth could easily jump several dollars overnight.

- Small businesses will struggle. Local dispensaries and craft growers already fight to stay competitive. Adding another steep tax may force many to close, leaving only big corporate out-of-state players.

- The black market wins. If legal weed gets too expensive, many will turn back to unregulated sources. That means less safety, no quality control, and fewer consumer protections.

What This Really Means

When Michigan voters approved legalization, the goal was simple: bring cannabis into the light, regulate it, and make it accessible. This tax hike flips that promise on its head. Instead of supporting a healthy market, Lansing is treating cannabis like a cash cow.

But here’s the truth: over-taxing cannabis doesn’t just hurt businesses — it hurts consumers and patients.

What You Can Do

- Speak Up. Contact your state representative or senator and tell them you oppose the 24% cannabis tax. Politicians need to hear from voters, not just lobbyists.

- Support local shops. Keep your dollars with Michigan-owned dispensaries and growers who are most at risk from this tax.

- Stay informed. Share news about the proposed tax with friends, family, and on social media. Many people don’t know this is happening.

- Vote with cannabis in mind. Remember which lawmakers supported this tax when election season comes around.

The Bottom Line

Michigan’s cannabis market is still young and fragile. A 24% wholesale tax isn’t just unfair — it risks undoing everything legalization set out to achieve. We can’t let Lansing price people out of safe, regulated cannabis.

If you care about fair access, local businesses, and keeping cannabis affordable, now’s the time to raise your voice.

Additional Information & Links

Cannabis industry advocates, lawmakers say 24% tax on Michigan marijuana is too high